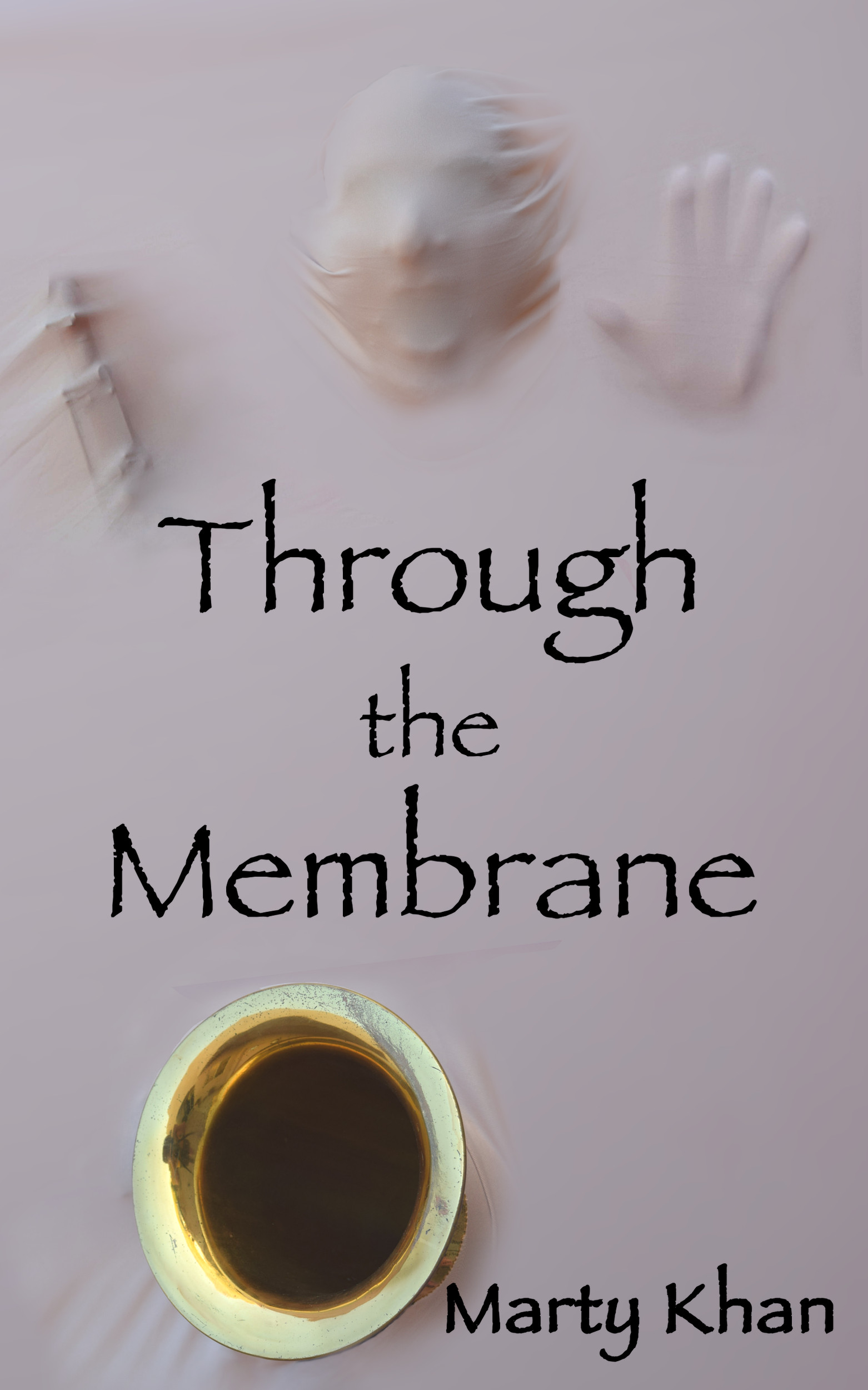

A Comprehensive Guide to the Business of Jazz

Without Sacrificing Dignity or Artistic Integrity

By Marty Khan

Drawing on 35 years of experience in virtually every aspect of the jazz and performing arts business, Marty Khan has created a comprehensive guide for jazz musicians and professionals. 450 pages long and printed on high-quality 8 1/2 x 11 stock, this book offers highly detailed information and advice about everything they need to know to successfully navigate the difficult, mysterious, and often treacherous waters of the jazz business. It also focuses strongly on the Performing Arts business, and the role that jazz plays in relation to it.

Interview with Author, Marty Khan

Seven Keys to Empowerment and Productivity

This Book

* explains and de-mystifies everything involved in the business of recording and performing;

* defines and clarifies the various roles and responsibilities of everyone with whom the artist will be dealing;

* offers specific advice on making the most out of every relationship and opportunity;

* offers comprehensive and explicitly detailed information regarding the 501(c)(3) non-profit corporation, including set-up, operation, development and fundraising;

* describes specific methods and concepts that are productive, cost-effective and proven to be viable;

* provides samples of contracts, agreements, corporate business structures, releases, stage plots and other useful materials.

UPDATE

There is a change in section F of Part IV, Chapter 1: the very last question about when the organization has to file for the first time. It now has to file from its first year of existence (due the 15th day of the 5th month following the end of the fiscal year – so May 15 for an organization whose FY is the regular Jan 1 – Dec 31 calendar year). But now, if the budget is below $50,000, you don’t have to file a formal 990 report. You can file a 990N e-postcard that simply states that you didn’t have enough income to file. There are variations on this state-to-state by local rules, but that’s it as far as the IRS is concerned.

Also, in section B, question 4, the IRS filing fees have been raised from $150 – 400 to

$400 – 800.